Buying a property in Chhattisgarh? Here is a detailed guide on how to pay stamp duty and registration charges in Chattisgarh.

When you buy a house in Chhattisgarh or any state in India, to make it legally yours, you need to do the registration process. This involves the payment of registration charges and stamp duty to the state government. According to the Registration Act 1969, it is mandatory to register your property and pay stamp duty charges. Learn all about stamp duty and registration charges in Chhattisgarh as of the year 2025, in this blog.

What is Stamp Duty in Chhattisgarh

Indian Stamp Act, 1899, Section 3, states that a home buyer must pay a tax on all property transactions, which is known as Stamp Duty. Such taxes are paid to the state government, meaning the Chhattisgarh government. Payment can be made online or offline. Online payment is made through an e-stamping website. Once the property is registered and stamp duty charges are paid, the property legally becomes yours.

Also, you can claim a tax benefit under Income Tax Act, 1961 Section 80C. A tax benefit of up to Rs 1.5 lakh can be claimed on registration charges payment.

Stamp Duty and Registration Charges in Chhattisgarh 2025

A homebuyer in any city of Chhattisgarh will have to pay 5% Stamp Duty. The registration charges in Chhattisgarh is 4% of market value of the property.

Stamp Duty charges in Chhattisgarh in 2025 are as follows:

|

Property owner |

Stamp Duty in Chhattisgarh |

|

Man |

5% |

|

Woman |

4% |

|

Joint (Man and woman) |

4% |

Registration Charges in Chhattisgarh in 2025are as follows:

|

Property owner |

Registration charges in Chhattisgarh |

|

Man |

4% |

|

Woman |

4% |

|

Joint (Man and woman) |

4% |

Let’s understand with an illustration how stamp duty in Chhattisgarh and registration charges are calculated:

Suppose Alok has purchased a property in Raipur for Rs 45 lakh, so while registering a property, he will have to pay registration charges and stamp duty charges to the state government. The registration charges are 4%, and stamp duty charges are 5%. Alok’s calculation will be as given below:-

-

Stamp duty charges 5% of Rs 45 lakh= Rs 2,25,000

-

Registration charges 4% of Rs 45 lakh= Rs 1,80,000

-

Total of stamp duty and registration charges= Rs 4,05,000

Stamp Duty Payment Methods in Chhattisgarh

Stamp duty in Chhattisgarh can be paid using both online and offline methods. Pay the charges at your convenience. We have listed out the process for both the methods below:-

-

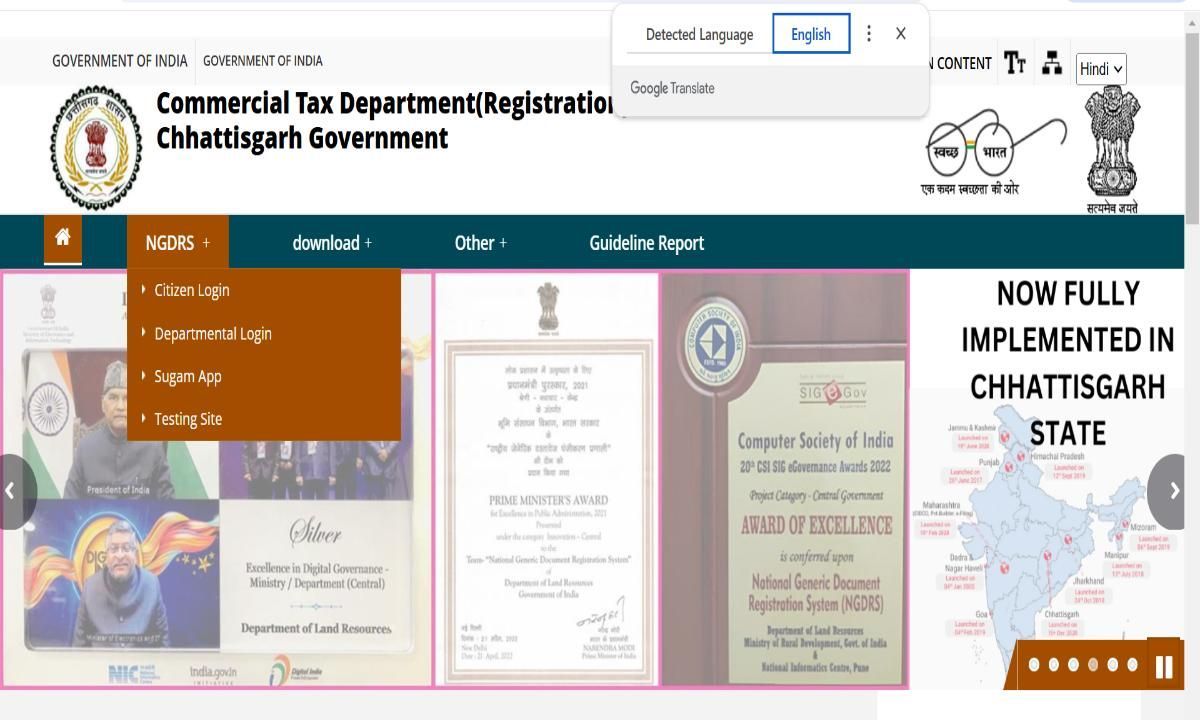

Online: You can pay stamp duty charges online in Chhattisgarh using an e-stamping portal. You have to log in (if you are a registered customer); if not, register on the website. Once login is done, you can easily download the e-stamp paper and then make the payment at the nearest Sub-registrar’s office. You can pay through debit/credit card or UPI transactions at the office.

Online Property Registration Process in Chhattisgarh

To register the property online in Chhattisgarh, you will need to perform the following steps:-

- Step 2: Scroll down a bit, where you will find a note stating that ‘E-registration (registration of immovable property) application software, NGDRS, has been implemented in all 102 sub-registrar offices of Chhattisgarh state.”

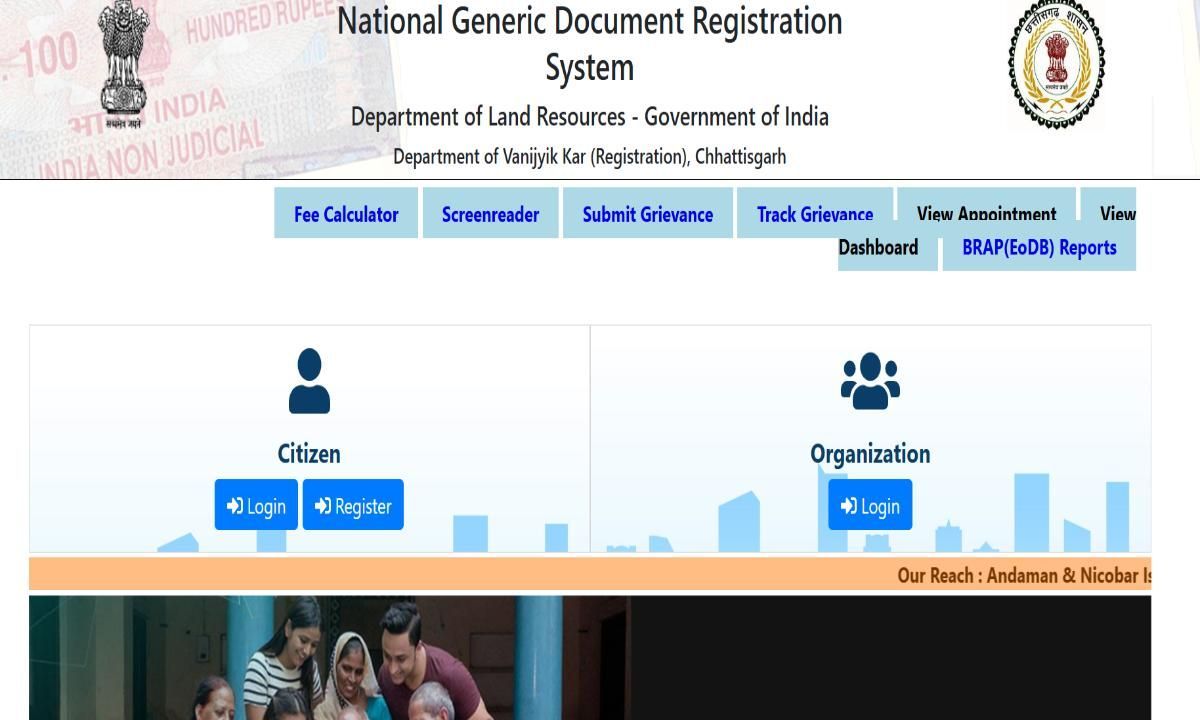

- Step 3: Go to NGDRS portal

- Step 4: Login on the portal using the credentials. Click on Property Registration

- Step 5: A form will open up on the NGDRS, a citizen must fill out the following form.

- NGDRS Login RegistrationFill the following details in the citizen registration form of NGDRS

- Citizen Type (Indian or NRI)

- Address

- State

- District

- Email Id

- Username

- Password

- Captcha Code

- Once you fill in the aforementioned details and click on the ‘Submit’ button, you will be registered on the NGDRS website.

Documents Required for Property Registration in Chhattisgarh

It is mandatory to submit the required documents to the Registrar Office within four months of property registration. Section 25 of the Registration Act 1969 states that if documents are not offered on time, a fine will be imposed on a home buyer. To ignore such an incident, keep the following documents ready:-

-

Property registration form

-

Copy of Land or Building registry

-

Lease copy

-

A Hrin Pustika / Khasra copy

-

Copy of allotment/registry issued for land or building by a government department

-

Electricity Bill, if there is an encroachment case involved.

Stamp Duty Refund in Chhattisgarh

Yes, a refund of stamp duty in Chhattisgarh is available, but only if it is an e-stamp. For the refund, an individual will have to fill out the refund form and submit it to the collector to initiate the process. On the form following details should be mentioned:-

-

Name/ID/certificate no./date of application

-

Bank details, where you wish to receive a refund

The officer will review the documents and initiate the refund request. However, ten per cent of the total amount will be deducted as a service charge.

Factors Affecting the Stamp Duty in Chhattisgarh

When stamp duty and registration charges in Chhattisgarh are calculated, the following factors are considered:-

-

Property owner’s age and gender: The stamp duty rates (Stamp duty in Chhattisgarh) are 5% for males, whereas a 1% rebate is given to female property owners. This is done to promote women home buyers more.

-

Location of property: In urban city areas, stamp duties are higher. Meanwhile, in rural areas, the stamp duty is lower.

-

Property Type: Stamp duty differs for every property type. Charges are higher for commercial property and lower for residential property.

-

Amenities: If your property has high-end amenities, stamp duty charges are higher and vice versa.

Conclusion to Stamp Duty and Registration Charges in Chhattisgarh

To sum up, it is mandatory to register a property in Chhattisgarh to become a legal owner of a property. While doing a registry, stamp duty and registration charges are paid, which are dependent on the market value. Once stamp duty in Chhattisgarh is paid, you should submit the documents in the stipulated time to avoid any penalty. Enjoy the legal rights of your property after completing the registration and payment process. For any further queries, you can leave a comment, and we will get back to you with more information.

Disclaimer:

Magicbricks aims to provide accurate and updated information to its readers. However, the information provided is a mix of industry reports, online articles, and in-house Magicbricks data. Since information may change with time, we are striving to keep our data updated. In the meantime, we suggest not to depend on this data solely and verify any critical details independently. Under no circumstances will Magicbricks Realty Services be held liable and responsible towards any party incurring damage or loss of any kind incurred as a result of the use of information.

Please feel free to share your feedback by clicking on this form.

Show More