A citizen of Nizampet must pay the Nizampet Municipal Corporation property tax twice a year. In this blog, learn how to pay Nizampet municipal corporation property taxes, a penalty for not paying on time and more.

Property owners under the Nizampet Municipal Corporation are required to pay property tax each year. Nizampet is a city and municipal corporation in Telangana’s Bachupally mandal, Medchal-Malkajgiri district. It is located in Hyderabad’s northwestern outskirts. Nizampet Municipal Corporation is in charge of the city’s administration.

Nizampet Property Tax

In India, property tax is one of the most important sources of revenue for municipal corporations. The property tax is levied on all residential, commercial, and industrial properties within the Municipal Corporation’s boundaries.

Nizampet, an emerging area in Hyderabad, has its own set of property tax regulations administered by the Nizampet Municipal Corporation. In this volatile market, homeowners must be aware of the tax rates and possible concessions for specific properties. The Commissioner And Director Of Municipal Administration (CDMA) Telangana determines. Nizampet’s property tax. Property size, location, and usage are all important factors in determining the tax amount in Nizampet. CDMA Telangana is the Municipal Administration Department under the Government of Telangana. These tax contributions are used to fund a variety of civic projects and infrastructure improvements in the city.

Citizens in Nizampet can pay their property tax in person at their local municipal office. They can also pay their Nizampet property taxes online via the CDMA Telangana’s official website. This article will go over the various aspects of Nizampet property tax and its payment methods.

Nizampet Property Tax: Self-Assessment

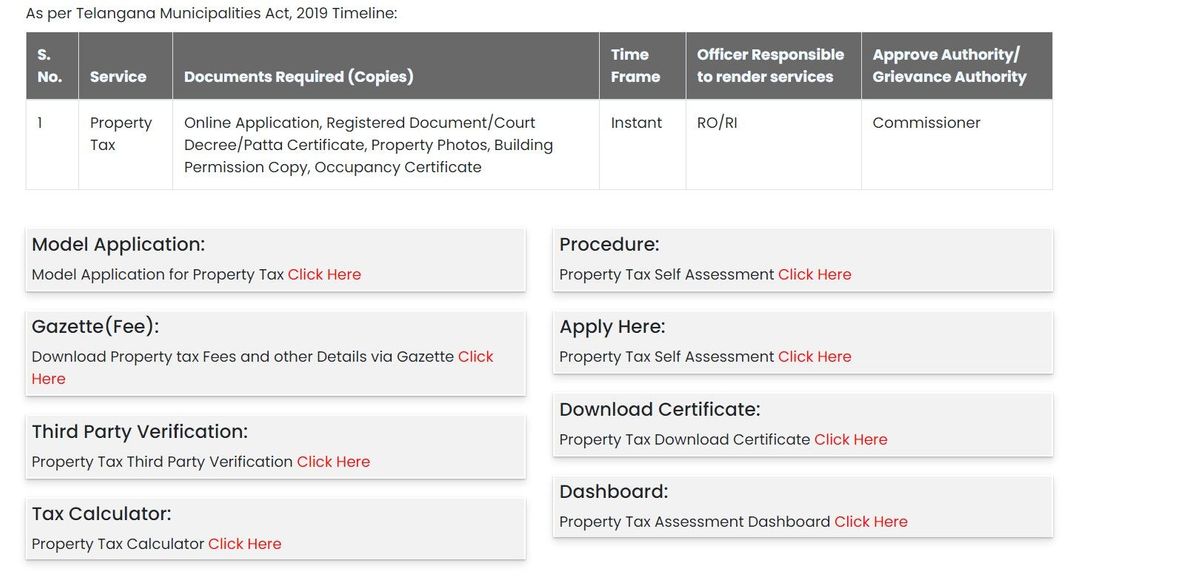

A property owner in Nizampet can apply for self-assessment on the CDMA Telangana’s official website using the following steps:

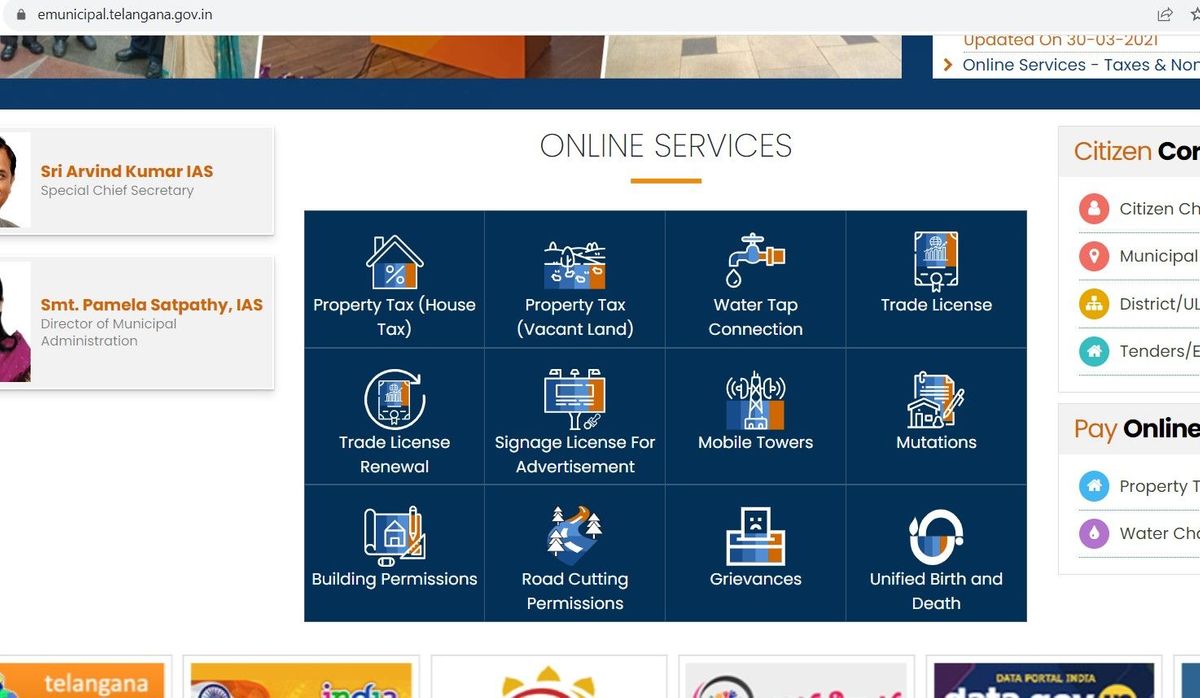

Step 1: Visit the CDMA Telangana’s official website (https://emunicipal.telangana.gov.in/) and Scroll down to the ‘Online Services’ section. Click on the ‘Property Tax (House Tax)’ option.

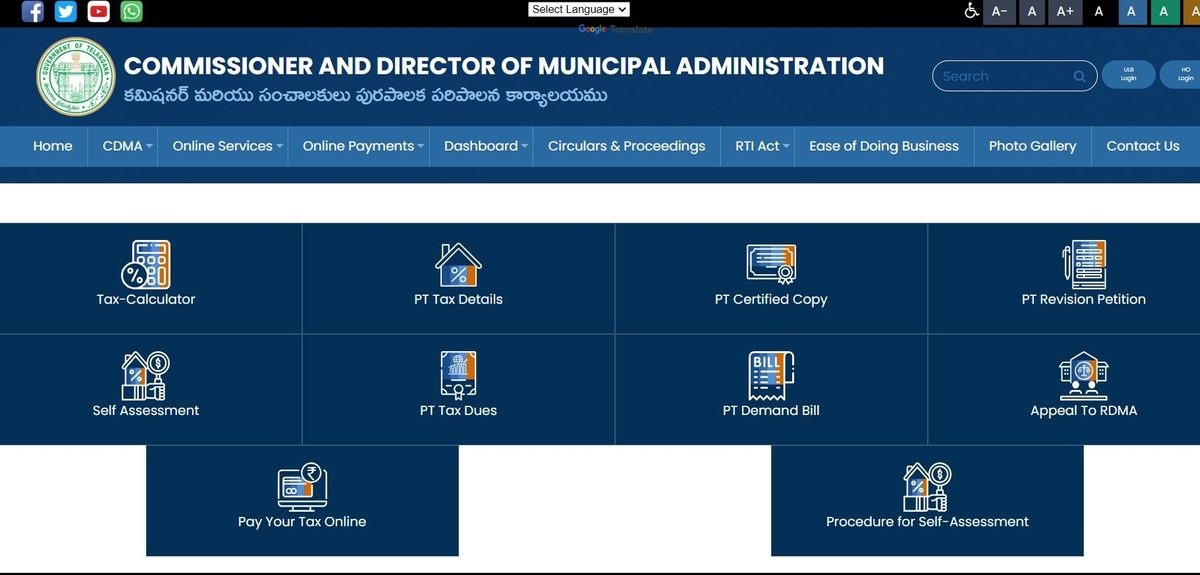

Step 2: Click on the ‘Self Assessment’ option on the new webpage.

Step 3: Read the steps for the online procedure carefully, and click ‘Click Here’ under the ‘Apply Here’ option.

Step 4: Enter your contact number and complete the OTP verification.

Step 5: Fill in the details, including property measurements, and upload any required documents. The system calculates and displays the half-yearly tax based on the measurements.

Nizampet Municipal Corporation Property Tax Calculation

Following is a formula to calculate Nizampet Municipal Corporation property tax:-

Property tax = base value × built-up area × Age factor × type of building × category of use × floor factor.

Some of the factors which are used to assess the property tax in Bhopal are:-

-

Property locality

-

Occupancy status of the property- rented or owned

-

Type of property- residential, commercial or industrial

-

Amenities offered include a car park, rainwater harvesting, a store, etc.

-

Construction year

-

Type of construction

Nizampet Property Tax Payment

Find below online and offline methods of paying Nazampet Property Tax.

How to Pay Nizampet Property Tax Online?

The Nizampet property tax is an annual duty that property owners must pay. Individuals can easily pay their property taxes online. A property owner can pay property tax online by visiting the CDMA Telangana website and following the steps outlined below:

Step 1: Visit the CDMA Telangana’s official website (https://emunicipal.telangana.gov.in/) and Scroll down to the ‘Online Services’ section. Click on the ‘Property Tax (House Tax)’ option.

Step 2: Click ‘Pay your Tax Online’. A new webpage will appear.

Step 3: You have to enter your 10-digit Property Tax Identification Number (PTIN) to proceed. Click ‘ Know Property Tax Dues’.

Step 4: Check for details such as property tax, outstanding payments, and interest on late payments. You have the option of paying via net banking, credit or debit card.

Step 5: Fill out all of the information in the payment gateway and complete the payment. You can choose from various online payment methods, including credit cards, debit cards, internet banking, and NEFT/ RTGS.

Step 6: The receipt for the property tax payment will be generated. You can download, print, and save it for future use.

Nizampet Property Tax Payment for Vacant Land

The Municipal Corporation also taxes vacant land within its boundaries based on certain norms. The vacant lands are recognized and assessed for the purpose of calculating a Vacant Land tax, which is levied on the owner of the specific vacant land by the Urban Local Body’s Revenue section. The following are the main functions of the Revenue section in relation to Vacant Land Tax.

-

Acceptance of the application for assessment, inspection, and processing.

-

Sending notices to the owner of vacant land.

-

Evaluation of the Vacant Land Tax.

-

Sending out demand letters.

-

The collection of taxes and the record keeping.

-

Receipt of title transfer application, assessment, processing, title transfer recording, and collection of title transfer fee.

Steps for payment of Nizampet Property Tax for Vacant land are as follows:

Step 1: Visit the CDMA Telangana’s official website (https://emunicipal.telangana.gov.in/) and Scroll down to the ‘Online Services’ section. Click on the ‘Property Tax (Vacant Land)’ option.

Step 2: Read the steps for the online procedure carefully, and click ‘Click Here’ under the ‘Apply Here’ option.

Step 3: Enter your mobile number and complete the OTP verification.

Step 4: Fill out the details and upload the required documents. Apply. You will receive an Application ID via an SMS for future reference. When the application is submitted, it is routed to the Revenue Inspector (RI) for inspection.

Step 5: The Revenue Inspector (RI) conducts the inspection and submits the field report. The application is sent to the Revenue Officer (RO) for review and approval.

Step 6: The RO verifies and approves the application and forwards it to the Municipal Commissioner (MC) for review.

Step 7: The MC finally verifies and approves the final application. After the final approval, you will get a payment link via an SMS.

Step 8: Following successful payment, a 10-digit assessment number is generated.

Note: This process takes 15 Days.

How to Pay Nizampet Tax Payment Offline

The property tax can be paid in person or by mail. It entails going to the local municipal authority’s office. The taxpayer must submit the necessary details and documents for the respective holding number at the designated counter. The official will specify the details and the amount due. The tax collector can be paid in cash, by check, or by demand draft.

Applicability for Nizampet Property Tax

The following individuals are required to pay Nizampet property tax:

-

An individual who is over 18 years of age.

-

A person who has made Nizampet their permanent home.

-

A property tax is payable by anyone who owns property in Nizampet

Nizampet Property Tax Exemptions

Property tax exemptions are available for the categories listed below:

|

Category |

Exemption |

|

1. Properties with monthly rental (in Rs) |

|

|

Up to 50 |

No Tax |

|

51 – 100 |

2% |

|

101 – 200 |

4% |

|

201 – 300 |

7% |

|

More than 300 |

15% |

|

2. Properties of ex-military service members, charitable trusts, religious places |

No Tax |

|

3. Recognized Educational Institutions |

No Tax |

|

4. Vacant property (based on the report submitted by the Tax inspector) |

50% |

Penalty for Not Paying Nizampet Property Tax

If taxpayers fail to pay their tax dues within the specified time limit, the municipal corporation may levy a penalty of 2% of the property tax rate.

If you have any questions or issues regarding the payment of Nizampet property tax, you may contact a professional on these details:

Official Address: Nizampet Municipal Corporation office, old Gram Panchayat Office Pragathi Nagar, 500090.

Phone Number: 21111111

Email Id: mc.nizampetulb@gmail.com

Website: https://nizampetcorporation.telangana.gov.in/

If you wish to register a complaint, you may visit the official CDMA Telangana portal and raise an online complaint there.

Summing Up Nizampet Property Tax

Paying Nizampet property tax can be simple if you follow the correct steps. We hope this quick guide helps you make your property tax payment as simple as possible. The availability of offline and online payment options has simplified the process of paying Nizampet property tax. If you don’t have access to the internet, you can pay your Nizampet property tax in person at the Nizampet Municipal Corporation office.