Property owners in Himachal Pradesh must pay Himachal Pradesh property tax to avoid penalties. Here’s a guide to paying property tax Himachal Pradesh property tax online, the latest rebate schemes and more!

Property tax is a tax the government imposes on a person’s non-movable residential or commercial property. It is evaluated on the basis of the property type and the jurisdiction under which the property comes. Himachal Pradesh property tax is levied on all the residents of Himachal Pradesh. They are obligated to pay their property taxes in order to avoid penalties. In this blog, we take a close look at Himachal Pradesh property tax and provide a comprehensive guide to submitting your payment.

The Himachal Pradesh Municipal Corporation (HPMC) Act, 1994

The Himachal Pradesh property tax is levied adhering to the guidelines of The Himachal Pradesh Municipal Corporation (HPMC) Act, 1994. Chapter VIII of the Act outlines everything you need to know about property tax assessment and collection methods. This information is readily available online and consumers can verify and cross-refer all the details that they need to know. You’ll also find information on which properties are eligible for taxation and the rates at which they’ll be taxed.

When to Pay Himachal Pradesh Property Tax

In Himachal Pradesh, the last date to pay property tax is March 31. The Himachal Pradesh property tax has to be paid by all the property owners of Himachal, whether they own residential, commercial or industrial property. The municipal corporation is also offering a discount of 10 per cent to the early payers. If a citizen is unable to pay the taxes, then they will have to pay a penalty of 5 per cent. Also, the Municipal Corporation of Shimla announced that if the defaulters are unable to pay the taxes, the corporation will cut the electricity and water supply.

The Shimla Municipal Corporation has given a one-year property tax exemption to the newly merged areas of Mashobra, Beolia, and Lambidhar, which were recently integrated into the corporation’s jurisdiction. According to the Himachal Pradesh property tax rule, for a year, property tax is not charged from newly merged areas for a specific period after their inclusion.

Why Is Himachal Pradesh Property Tax Collected?

Himachal Pradesh property tax is collected by the local municipal corporations. Funds are added to the treasury of the state, which utilizes these taxes to provide amenities to the residents. These amenities include the roads, street lights, cleanliness etc.

The Municipal Corporation of Shimla has made the assessment and collection of Himachal Pradesh house tax more straightforward and transparent than ever. It has even granted limited powers to increase or decrease House Tax and allows self-assessment of Property Tax.

Himachal Pradesh Property Tax is levied on which properties?

Property tax applies to all types of residential and commercial buildings as well as any type of land owned by residents in Himachal Pradesh. The Himachal Pradesh Municipal Corporation (HPMC) is responsible for implementing Himachal Pradesh Property Tax. It is levied even if the property is occupied or rented out or even if it is empty, a commercial one, factory, office, hotel, bar, or godown. So, whether you’re living in a cosy apartment, running a successful business, or hoarding a large chunk of land, the HP Property tax applies to you.

Who Must Pay Himachal Pradesh Property Tax?

Let’s check out who is responsible for paying property tax in Himachal Pradesh.

-

If you’re an owner or joint owner of a property, then you are responsible for paying HP Property Tax.

-

If you’ve leased out your land or building, then the responsibility falls on the lessor.

-

If the land or building has been sublet, then the superior lessor is the one responsible for paying up.

-

Lastly, if the property isn’t leased out, but someone has the right to do so, then they’ll be the ones to pay the property tax.

So, whether you’re a property owner or just have the right to lease out space, make sure you’re aware of your responsibilities when it comes to property tax in Himachal Pradesh.

How To Pay Himachal Pradesh Property Tax Online?

If you belong to the state of Himachal Pradesh you can easily pay your property tax online. If you live in Shimla, there is a separate portal of the Shimla Municipal Corporation where you can pay your property tax. For people in all other places – including Shimla, the general HP portal can be accessed @ propertytax.hp.gov.in

Himachal Pradesh Property Tax Online for Shimla Residents

If you are a resident of Shimla you can pay your HP property tax online through the Municipal Corporation Shimla portal. Here are the steps on how to go about this payment.

-

To access the official portal for paying your Himachal Pradesh Property tax in Shimla you can login here – https://mybill.shimlamc.org

-

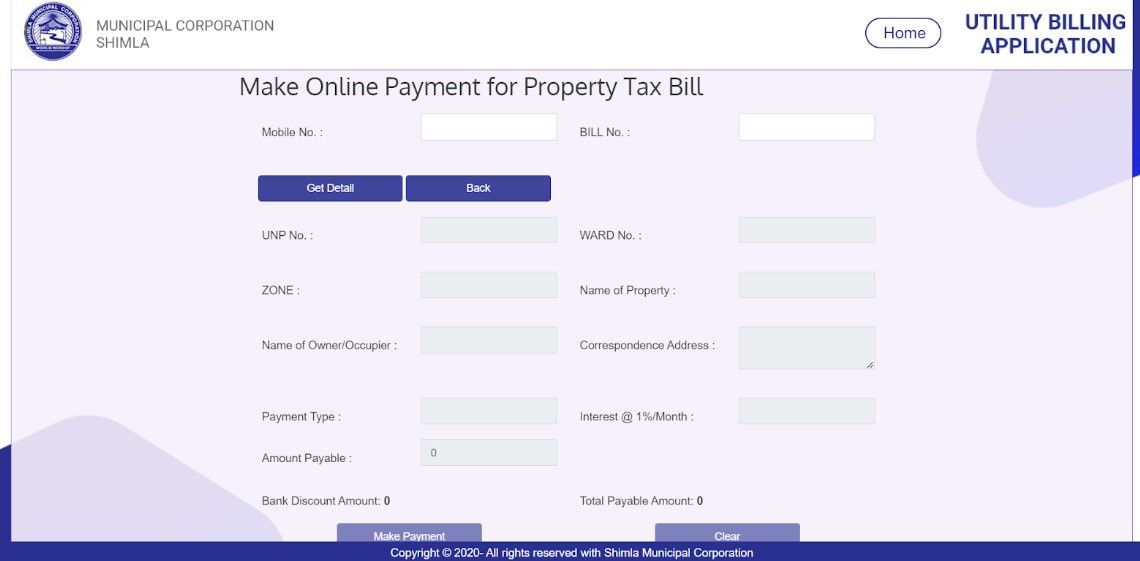

Click on “Property Tax.”

-

To go to the next screen, from the current page, choose the “Pay Property tax” tab.

-

When entering a property’s bill number, the information about that property will be shown on the current screen. To find your record, please enter the corresponding property information field into the box. I.D., Name, Billing, and Mobile Numbers.

-

Property and payment information are shown on the page. If everything seems alright, you may proceed to the checkout page by clicking the “Make Payment” button on the screen’s bottom.

-

Now, pick the appropriate payment gateway option (Credit/Debit card/Internet banking) to finish your transaction.

-

The transaction will produce a confirmation. Save it for later use by saving it or printing it out.

Himachal Pradesh Property Tax Online for all HP Residents

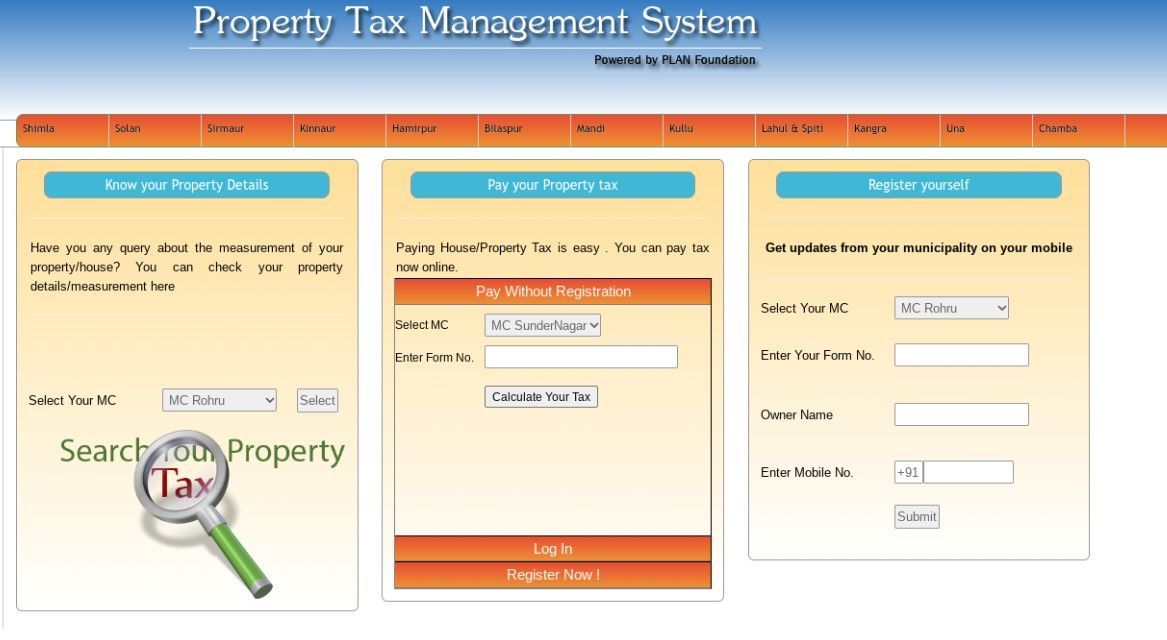

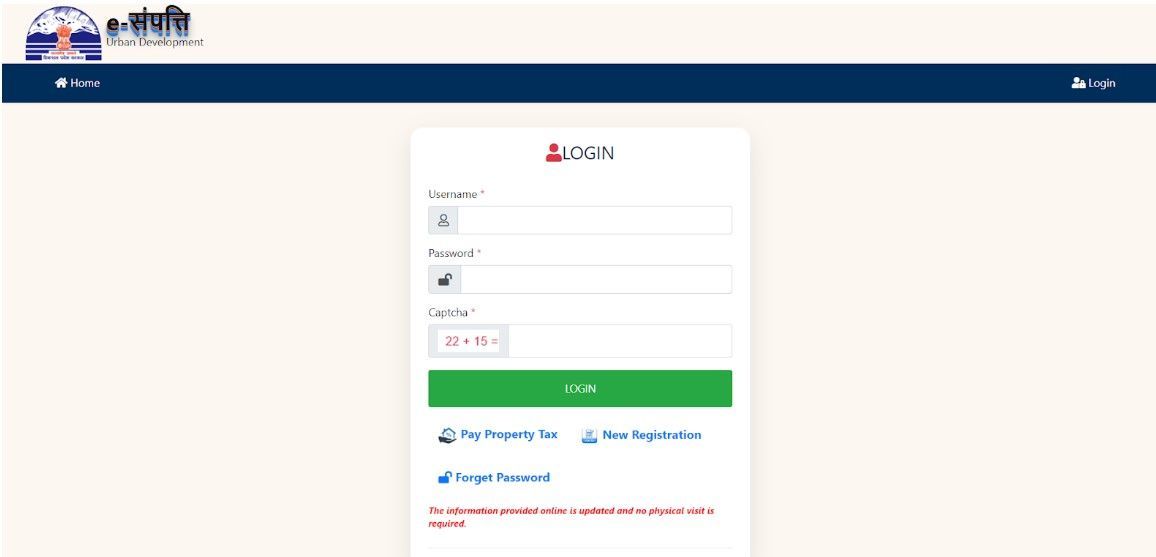

If you live anywhere in Himachal Pradesh, you can find out details about your property, pay your HP property tax, and register to vote via the state’s official internet site – https://hppropertytax.org

-

You will find the “Pay your property tax“ option in the middle, as per the web link.

-

To continue with HP house tax online payment, enter the form number in the box marked “Input Form No.” and click the “Calculate Your tax” option. (For now, MC Sundernagar may make use of this choice.)

-

The “Register Now!” button allows the user to sign up by answering a few simple questions and submitting his information.

-

After a person has completed registration, they may begin completing online transactions by clicking the “Log In” button just above the “Register Now” button.

How To Pay Himachal Pradesh Property Tax Offline?

Property taxes in Himachal Pradesh are to be paid at the central office of the relevant municipal corporation. You can also pay the bill at the branches of your municipal corporation. These offices allow payment through cash, cheque, or bank draft. Ensure that you pay taxes before the deadline mentioned on the invoice. Delayed payments, defined as those made more than one month after the end of the fiscal year, shall incur interest at the rate of 1% per month until the date of payment.

Which Properties Are Exempt from Paying Himachal Pradesh Property Tax?

Not everyone in Himachal Pradesh has to pay property tax. Here is the list of those exempted:

-

Farmland and outbuildings which are not attached to the main residence.

-

Real property that is only used for religious or charitable reasons (with the corporation’s permission), for public burial or cremation purposes, or for other similar uses. Historic districts and properties that meet these criteria are also granted tax breaks.

-

Corporate-owned real estate that is vacant because it is not rented or leased.

-

Those who worked for the Delhi Police, the Central Industrial Security Force, or the Paramilitary Forces and were killed in the line of duty receive compensation for one residential property they own in the city.

-

Any employee or official of the Municipal Corporation of Delhi who suffers a permanent and total disability while on the job is exempt from paying Himachal Pradesh Property tax on their first personal residence.

-

A single home owned by an athlete who has won medals in the Olympics, the Asian Games, or the Commonwealth Games.

-

The following individuals are also exempt from paying property taxes on one of their homes:

-

Women who lost their husbands in the defence services or have received medals for valour, such as police, military, and paramilitary personnel.

-

Awardees of the nation’s highest decoration for courage among the general public.

-

Service members with a disability rating of 76% to 100% due to injuries received in combat or combat training.

So, if you fall under any of these categories, then you don’t have to pay Himachal Pradesh property tax.

Summing Up Himachal Pradesh Property Tax

Paying property taxes is the duty of every resident. This ensures the availability of better amenities. The government evaluates property from the time it is built or purchased or by its type. Then annually, levies a tax on it. For the ease of the residents, they are allowed to pay HP house tax in both online and offline mode through easy steps.

Disclaimer:

Magicbricks aims to provide accurate and updated information to its readers. However, the information provided is a mix of industry reports, online articles, and in-house Magicbricks data. Since information may change with time, we are striving to keep our data updated. In the meantime, we suggest not to depend on this data solely and verify any critical details independently. Under no circumstances will Magicbricks Realty Services be held liable and responsible towards any party incurring damage or loss of any kind incurred as a result of the use of information.

Please feel free to share your feedback by clicking on this form.

Show More