Stamp duty in Tripura is to be paid when carrying out a property transaction in the state. Go through the post to learn about stamp duty and registration charges in Tripura in detail.

Stamp duties are levied under the Indian Stamp Act of 1899, which the central government has revised multiple times throughout the years. Every state has the right to impose its stamp duties under these central acts. Therefore, while comparable across the States, the stamp duties’ specific elements also take on State-specific characteristics. This article will explain stamp duty in Tripura in detail.

The stamp duty and registration charges are not the same in all Indian states. Stamp duty in Tripura is a crucial tax that must be paid to the state’s respective city authorities when purchasing a property in Tripura.

About Stamp Duty and Property Registration in Tripura

The Tripura state government sets the value of the land. Stamp duty and registration charges are calculated using the state government’s market value of the land. The stamp duty in Tripura varies based on the location and commercial value of the property.

Property registration necessitates verifying and submitting a few required documents. The payment of stamp duty in Tripura serves as proof of record in cases of property disputes under the Indian Stamps Act 1899. With the help of technology, stamp duty in Tripura has become convenient and straightforward.

The Indian Stamp Act, 1899 (referred to as the Principal Act), as it exists in the State of Assam and has been extended to the State of Tripura, shall be altered for the purpose and in the manner set forth below in its application in Tripura.

Importance of Registration Charges and Stamp Duty in Tripura

The process of buying a house does not finish with the purchase price paid. A legal procedure will be required to declare you the property’s new owner. This occurs when stamp duty in Tripura has been paid and the property has been registered at the Sub-Registrar Office. The property will be regarded as illegal till then. If a property has not been subjected to the stamp duty and registration process, it cannot be protected from fraud.

The stamp duty in Tripura fees will be paid through the website, and the transaction will be registered at the Sub-Registrar Office. After completing a few legal processes, you would only be regarded as the genuine owner of that property.

Instruments That Are Subject To Stamp Duty in Tripura

The instruments shall be chargeable with stamp duty in Tripura in the amount indicated in that Schedule as the proper stamp duty; therefore, respectively, they are subject to the requirements of this Act.

-

A payment order for any amount of money to be paid weekly, monthly, or at any other specified interval.

-

A letter of credit is an instrument that authorizes one person to extend credit to the person in whose favour it is drawn.

-

A “bill of lading” includes a “through bill of lading” but not a mate’s receipt.

Stamp Duty and Property Registration Charges in Tripura

Find below the stamp duty and property registration charges in Tripura.

|

Charges Category |

Male |

Female |

|

|

Stamp Duty in Tripura |

5% |

5% |

|

|

Property Registration Charges in Tripura |

1% |

1% |

|

Factors Affecting Registration Charges and Stamp Duty in Tripura

The following things influence stamp duty in Tripura:

Property type and location: The location of property heavily influences the stamp duty in Tripura. It differs depending on the place. A property in an urban area is subject to more stamp duty than one in a rural area. Stamp duty in Tripura varies for properties in semi-urban locations. Similarly, stamp duty in Tripura on commercial properties is higher than on residential homes.

The property’s amenities: In today’s world, amenities are in high demand. If you desire a more luxurious life with more comforts and amenities, you will have to pay greater stamp duty in Tripura. Stamp duty in Tripura will be lower on properties with fewer amenities.

The property’s age: Another thing that affects stamp duty is the economy. The stamp duty in Tripura is reduced as the age of the property increases. As a result, a newly constructed home will have higher stamp duty and registration charges.

The buyer’s gender and age: Compared to a male buyer, a female buyer receives a stamp duty exemption. This is done in order to entice female buyers. The stamp duty and registration charges are also affected by the buyer’s age. In some states, senior citizens are eligible for a stamp duty rebate.

Stamp Duty in Tripura Calculation

Stamp duty in Tripura = Property Value x Tripura’s Stamp Duty Percentage

Stamp duty in Tripura is 5% of the property’s value.

How to Pay Stamp Duty and Property Registration Fees in Tripura

Find below a few simple steps to make stamp duty and property registration fee payments online in Tripura.

Step 1: Visit the official eGRAS website at egras.tripura.gov.in.

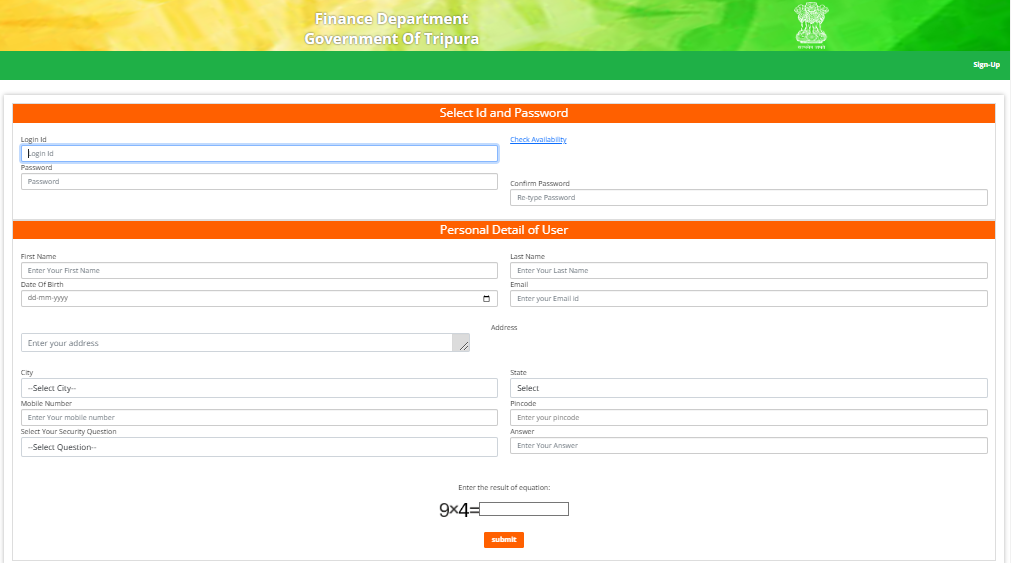

Step 2: Login to the website using your unique credentials. If you are not a registered user, proceed with signing up.

Step 3: Fill out the registration form.

Step 4: Select the appropriate service and provide the required details with supporting documents.

Step 5: Calculate the applicable stamp duty and property registration fees and make the payment.

Step 6: Check if you have received a payment receipt for the same. If not, download it from the website.

Documents Required Along with Stamp Duty in Tripura

-

A land map.

-

The original document with all parties’ signatures.

-

Power of Attorney

-

Property information (survey number, land details, size, etc.)

-

PAN Card

-

Challan for payment evidence, registration cost, and user charges.

-

Card of ownership.

-

Both the seller and the buyer must provide proof of identity, as well as the witness.

-

Aadhaar number

-

Original identification and proof of address.

-

The concerned valuation certificate by Tahsildar

E- Stamping of Stamp Duty in Tripura

In 2018, Law Minister Ratan Lal Nath declared that stamp duty in Tripura would be purchased in exchange for security money. This new approach would eliminate stamp duty and registration charge issues, and the money would be credited to the state exchequer, bypassing third-party intermediaries.

Instead of the paper-based non-judicial stamp duty in Tripura issued from approved collecting centres, which the central record-keeping agency designates in conjunction with the state government, an e-stamp is an electronically created impression on paper. The new approach will save money, reduce fraud, provide electronic authentication, and bring services to individuals’ doorsteps.

Adhesive Stamps Cancellation

(a) When affixing any adhesive stamp to any instrument chargeable with an obligation that any person has executed, they must cancel it, so it cannot be used again.

(b) Whoever performs any instrument on any paper carrying an adhesive stamp shall cancel the same at the time of execution of the stamp has previously been compensated in the manner mentioned.

(2) When it comes to stamp duty in Tripura, any instrument that has an adhesive stamp on it but hasn’t been cancelled means that it’s been stamped.

(3) Adhesive stamps can be cancelled by writing a person’s name or initials, the initials of his company, or any other effective method on or across the stamp.

The Bottom Line on Stamp Duty in Tripura

We hope the post helps you learn everything about stamp duty and property registration charges in Tripura. Paying registration charges and stamp duty in Tripura is a mandate at the time buying or selling a property. Make sure you are aware of the process for a smooth transfer.