Learn how to pay stamp duty in Surat by calculating the right amount, finding out the factors that affect stamp duty and the payment modes.

Stamp Duty in Surat along with the registration charges are counted as an integral part of the transaction process pertaining to property or land in the city of Surat, Gujarat. The registration and stamp duty in Surat, just like any other Indian state, are governed by the state government; in this case, the state government of Gujarat. Both of them play an important role in the legal acknowledgment of a land transaction, and hence are mandatory to be accounted for, across the nation.

The registration and stamp duty in Surat is also used as a tool by the government to create the need in the real estate market by strategically increasing or decreasing its rate, depending upon the profit or loss incurred by the market.

Why is It Mandatory to Pay Stamp Duty in Surat?

When the applicable stamp duty is duly paid on time on the respective house sale agreement, only then it is considered a ‘legal transaction’. On payment of respective registration and stamp duty in Surat, it gets automatically registered in the government records. It acts as legal proof pertaining to the sale or purchase of any land mass within the jurisdiction of the respective state government.

What Will Happen if you Delay the Payment of Stamp Duty in Surat?

By law, the applicable registration and stamp duty in Surat must be paid one day before, on the day, or on the next working day of the actual signing of the sales agreement within the jurisdiction of the Gujarat government. On failure or delay, you will be required to pay an extra 2 percent each month per delay, which can be stretched to 200 percent depending upon the type and location of land and the respective delay rate.

Factors Affecting Stamp Duty in Surat

The rates of registration and stamp duty in Surat are influenced by an array of determining factors. Let us discuss some of them in detail.

-

Circle Rates – Circles rates are the primary influencer of variation in stamp duty in Surat city. They vary even within the city, and lead to increment or decline in the rates of stamp duty, depending upon the market value of the area or property.

-

Location – The registration and stamp duty in Surat increases for a land, if it is in the vicinity of a good marketplace, school, college, hospital or other resourceful place.

Documents Required to Pay Stamp Duty in Surat

Following documents are required to pay stamp duty in Surat, Gujarat.

-

Title deed

-

Encumbrance certificate

-

Sale deed

-

Identification proof such as aadhaar card, PAN card

-

Proof of address such as electricity bill or passport

-

Power of attorney if applicable

-

Passport sized photograph of both buyer and seller

Things to Remember Before You Pay the Stamp Duty in Surat, Gujarat

Before you go ahead and pay your stamp duty registration charges in Surat, take a look at the things you should remember before doing so.

-

The stamp paper must be in the name of the person who is buying the property.

-

If the property deed is executed outside the specified territory, it will remain valid for 3 months and will need to be stamped within the same timeline.

-

The specific date on which the stamp paper was issued must not be more than six months from the date of transaction.

Registration and Stamp Duty in Surat for the Year 2025

Innumerable properties are sold and purchased everyday in the city of Surat. It is not a surprise that the Government of Gujarat (or any state for that matter), would want to profit off from this transaction in particular. Hence, the registration and stamp duty in Surat is one of the biggest sources of revenue for the Gujarat government.

The Gujarat Revenue Office (GRO), through the means of sub-registrar offices, is responsible for decisions pertaining to revision and declaration of charges for registration and stamp duty in Surat. As of 2025, following are the charges applicable on stamp duty in Surat.

|

Stamp duty Rates in Surat |

|

|

Stamp duty rate |

3.5 percent |

|

Surcharge |

1.4 percent |

|

Cumulative charges |

4.9 percent |

Let us now have a look at the registration and stamp duty in Surat, according to gender distinctions directed by the state government of Gujarat as of 2025.

|

Type of owner |

Applicable Stamp Duty in Surat (in percentage) |

Charges (in percentage) |

|

Male |

4.9 |

1 |

|

Female |

4.9 |

0 |

|

Joint property holder (male + male) |

4.9 |

1 |

|

Joint property holders (female + female) |

4.9 |

0 |

|

Joint property holder (male + female) |

4.9 |

1 |

How to Calculate Stamp Duty in Surat?

The registration and stamp duty in Surat is applicable to the total worth of the property (gross price) and is applied to the amount finally mentioned in the sanctioned sales agreement. However, it is to be noticed that these rates of the stamp duty in Surat, vary from area to area depending upon the determinants, discussed above.

To bring about the ease of access, transparency, and accountability when it comes to charges of registration and stamp duty in Surat,the state government of Gujarat made the entire process of paying the stamp duty hassle free and easy for anyone and everyone. All you have to do is simply visit the official web portal of the Inspector General of Registration (IGR) of the state government of Gujarat.

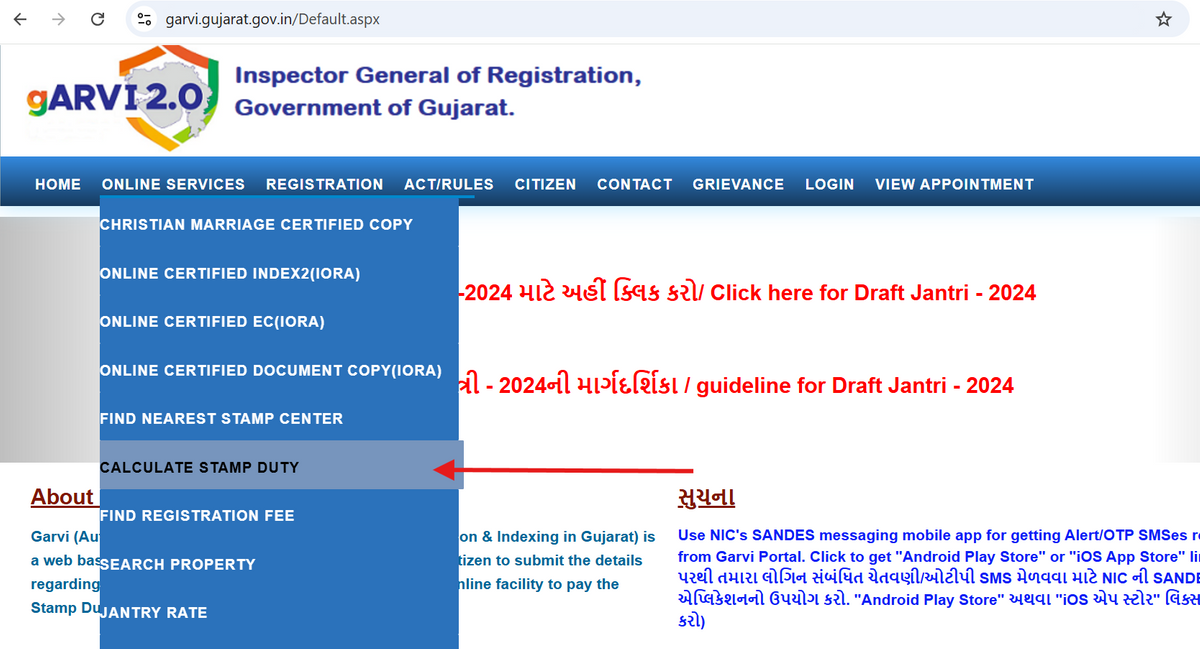

Step 1. Select the Calculate Stamp Duty as show in the image.

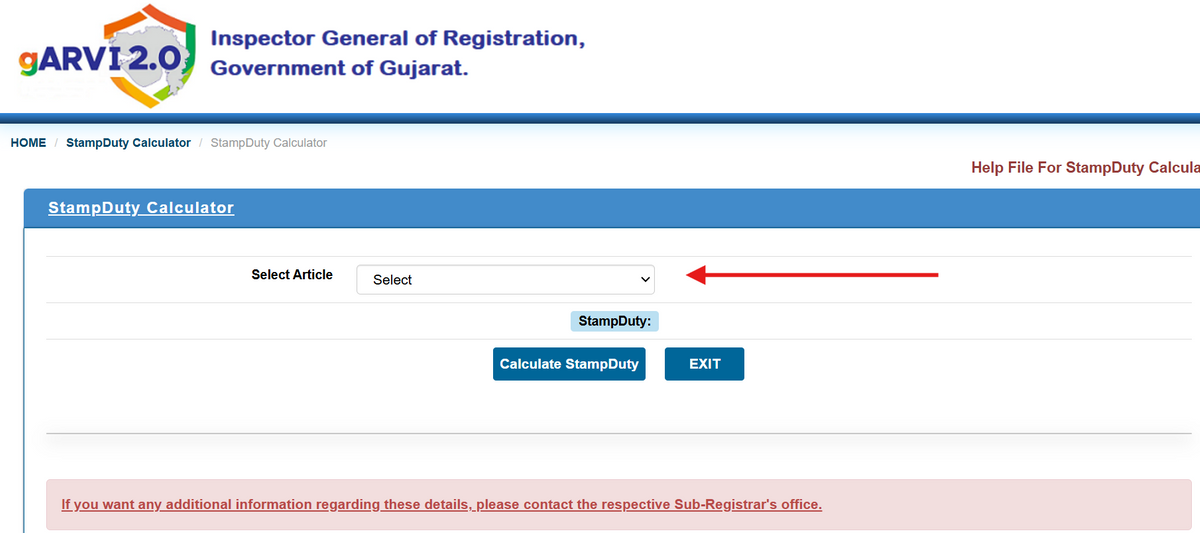

Step 2. Select the article for which you need to calculate the stamp duty and click ‘Calculate Stamp duty’.

How to Make Payment for Registration and Stamp Duty in Surat?

There are an assortment of ways through which you can easily pay your respective registration and stamp duty in Surat. To make this process even more convenient, the Gujarat government has collaborated with the Stock Holding Corporation of India (SHCI). Let us see how this system works.

1. By the means of authorized vendors

To make the process easier, the government of Gujarat has set up various authorized centres across the state to make the collection of stamp duty in Surat an easy process. For this purpose, the state government has given the authority to an assortment of commercial banks, post offices, and corporates to collect the respective registration and stamp duty in Surat.

2. Online method

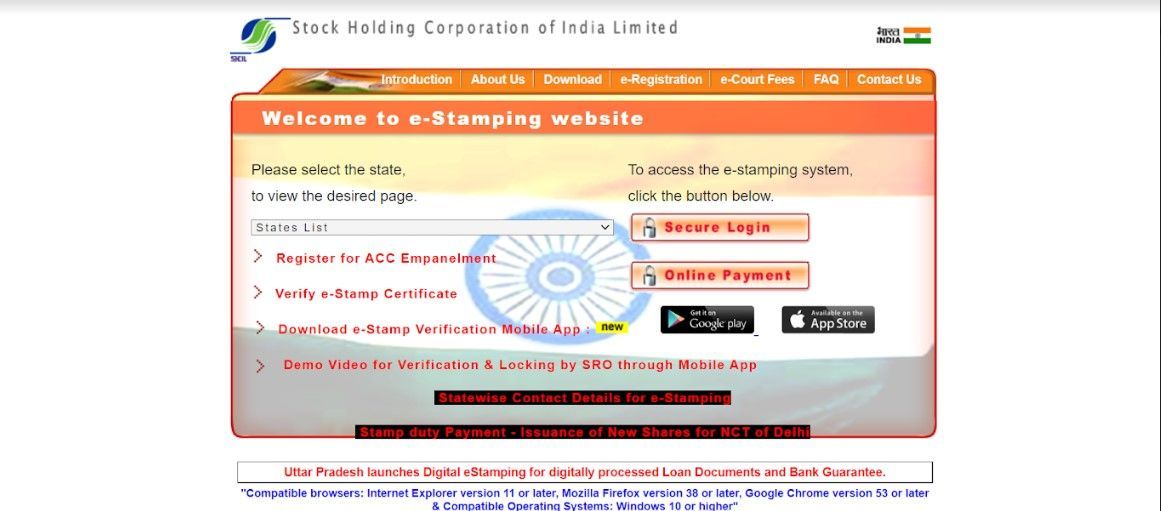

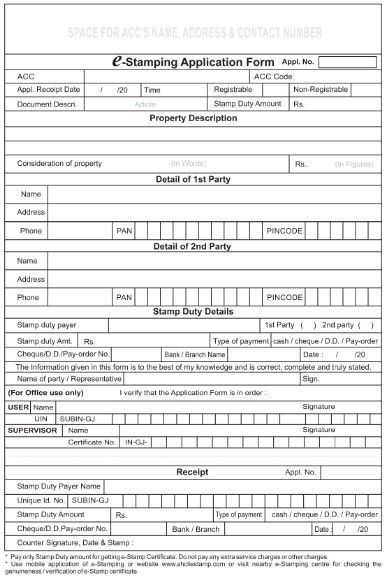

Historically, Gujarat was the first Indian state to commence the facility of e-stamps, using the power of the internet, while bringing about digital access amongst its citizens. For Surat and other localities in Gujarat, the registration and stamp duty charges can be paid by visiting the official web portal of the Stock Holding Corporation of India (SHCI).

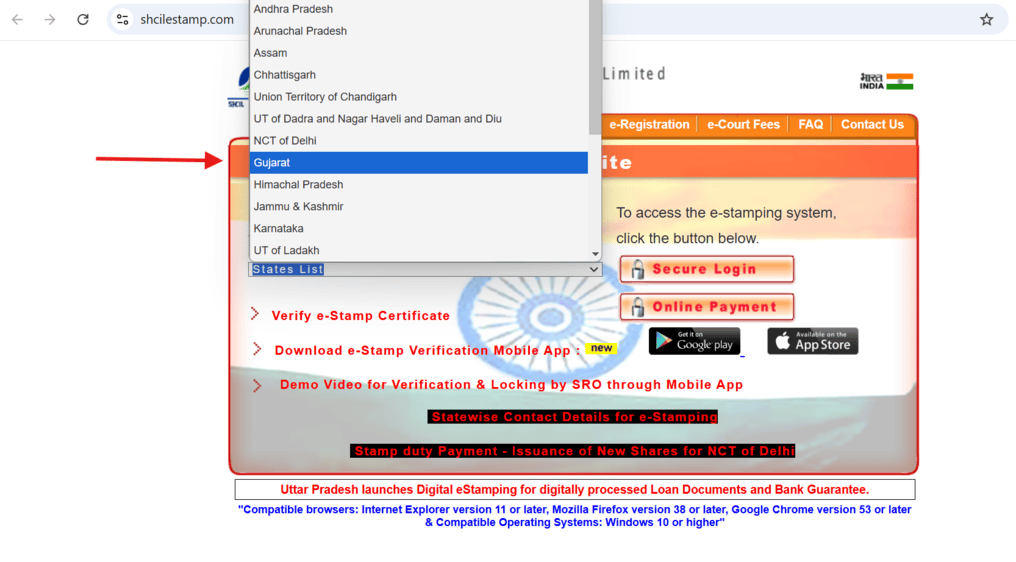

The Gujarat portal on SHCIL will open as shown in this image (Source: SHCIL’s official website)

-

You can choose to pay by the respective payment gateways, which include UPI, online banking, credit card and debit card.

3. Offline method

If it is not feasible for you to pay the respective charges for registration and stamp duty in Surat through an online medium, you can also pay the same offline. All you have to do is visit the nearest SHIC registered office or the office of the sub-registrar in Surat, and pay the due amount through debit card, credit card, cash, or demand draft.

You are free to register any sort of complaint, feedback, or raise a query ticket in front of the Gujarat Revenue Office (GRO) when it comes to registration and stamp duty in Surat or any part of Gujarat. You can do so by visiting the headquarters of the Gujarat Revenue Office, or by ringing their hotline.

Official address of the Gujarat Revenue Office –

Revenue Department,

Block no-11, New Sachivalay,

Gandhinagar

Gujarat (India)

Contact Information –

Contact Number :- +91 79 23251501, +91 79 23251507

In a Nutshell – Stamp Duty in Surat

The registration and stamp duty in Surat and other parts of the state of Gujarat are looked after, declared, and revised by the state government of Gujarat, through the Gujarat Revenue Office (GRO). These stamp duty charges are applicable on the net worth of the property, and are not a part of the sales agreement in-line; rather it is an addition to the total value calculated. It is important for buyers and sellers who are processing transactions in terms of property. This acts as legal evidence and automatically registers the transactionary asset in government records.

The government of Gujarat lets the people indulging in this transaction pay their due registration and stamp duty in Surat and other parts, via their affiliated vendors, online portals, and offline at the sub-registrar’s office. The stamp duty in Surat varies from area to area and depends upon an assortment of factors, including the gender of the owner, the location of the property, circle rates, type of land, among others.

Disclaimer:

Magicbricks aims to provide accurate and updated information to its readers. However, the information provided is a mix of industry reports, online articles, and in-house Magicbricks data. Since information may change with time, we are striving to keep our data updated. In the meantime, we suggest not to depend on this data solely and verify any critical details independently. Under no circumstances will Magicbricks Realty Services be held liable and responsible towards any party incurring damage or loss of any kind incurred as a result of the use of information.

Please feel free to share your feedback by clicking on this form.

Show More