Discover everything you need to know about property tax in Bhopal from how it is calculated to BMC Bhopal property tax exemptions, components and more. Read on to learn more.

Property owners in Bhopal are required to pay property tax to the Bhopal Nagar Nigam or BMC (Bhopal Municipal Corporation) for all types of properties, including residential and non-residential. However, calculating and paying this tax can be complex for some people. To simplify the process and ensure that Bhopal property tax payments are made easily, we have created a detailed guide to assist you.

About Bhopal Municipal Corporation

BMC covers a total of 463 sq km (250.29 sq mi). Currently, there are 85 BMC wards in Bhopal, each elects a corporator. The winning party forms a council responsible for various tasks, including public works, tax and revenue, water supply, fire brigade, health and sanitation, planning and development, finance and accounts.

Here’s a quick recap of BMC’s history:

-

In 1907, Bhopal introduced its first municipal body called Majlis-e-intezamia. After the Municipal Act’s enactment, the first city survey took place in 1916.

-

Additional villages were added under the municipal body in 1956.

-

The area under Bhopal’s municipal corporation increased to 71.23 sq km by 1975.

-

In 1983, the Bhopal Municipal Council was finally granted Municipal Corporation status.

How to Calculate Bhopal Property Tax

Here is how a Bhopal property tax is calculated:-

The formula to calculate the property tax is:-

Property tax = base value × built-up area × Age factor × type of building × category of use × floor factor.

Some of the factors which are used to assess the property tax in Bhopal are:-

-

Locality of the property

-

Occupancy status (rented or owned)

-

Type of property (residential, commercial or industrial)

-

Amenities offered (car park, rainwater harvesting, store, etc.)

-

Year of construction

-

Floor space index

-

Type of construction

-

The carpeted square area of the property

Bhopal Property Tax Payment Procedure

Citizens of Bhopal can make Bhopal property tax payments online or offline. However, the procedure for both mediums is different. Scroll down for a step-by-step guide.

How to Pay Bhopal Nagar Nigam Property Tax Online

If you prefer paying Bhopal property tax online, here’s what you need to do:

Step 1: Go to the official portal of Madhya Pradesh e-Nagar Palika (mpenagarpalika.gov.in).

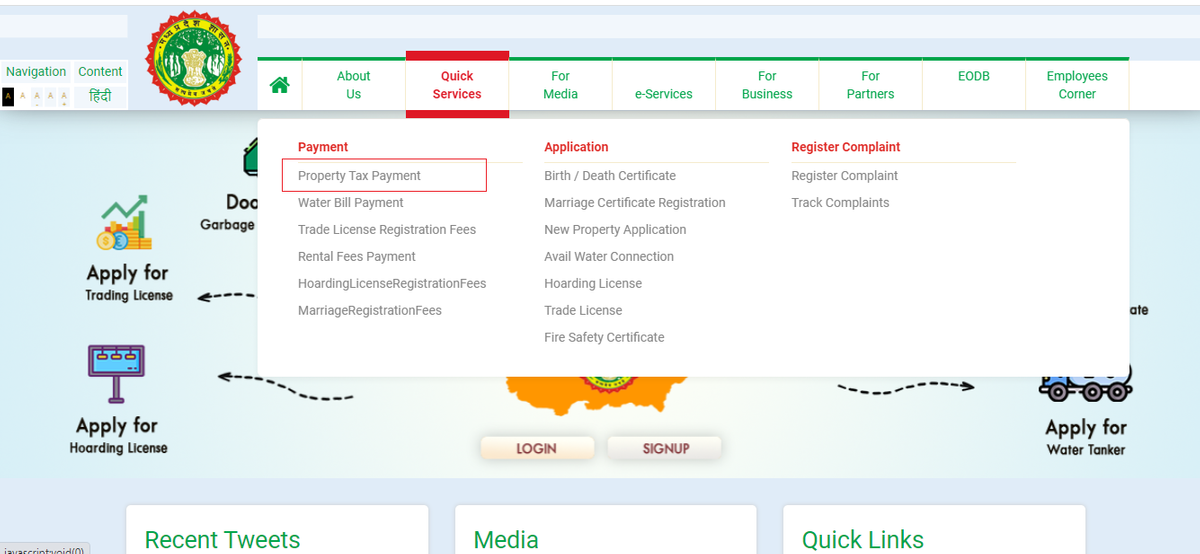

Step 2: From the main menu, select Quick Services and choose Property Tax Payment from the drop-down.

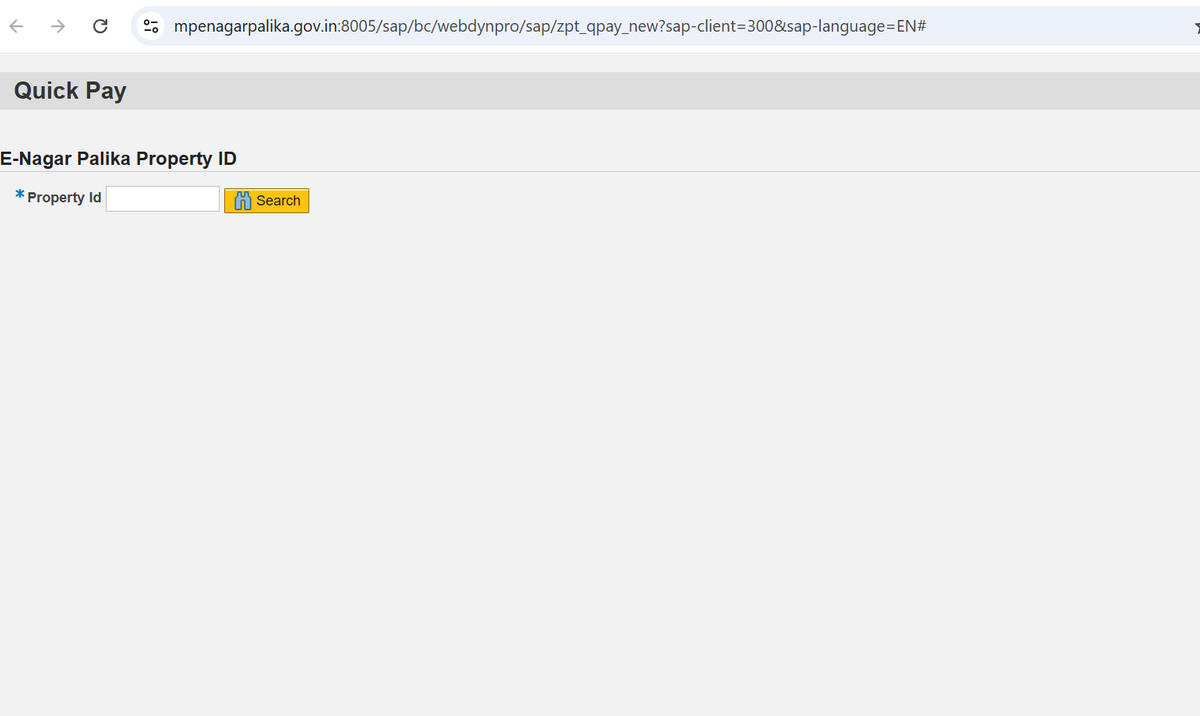

Step 3: When a new page appears, you will come across the Quick Pay option.

Step 4: Enter your property ID in the text box.

Step 5: After this, enter all the required details.

Step 6: After entering the details, click on the submit button.

Step 7: Once paid, you will receive a notification on your registered phone number and email address with a confirmation/receipt number.

Offline Method for Payment of Bhopal Property Tax

To pay property tax in Bhopal offline, follow the simple steps below:

Step 1: Visit your nearest BMC (Bhopal Municipal Corporation) office.

Step 2: Look for the authorised house tax payment counter in the ward office.

Step 3: Submit all the required documents and a tax amount via your preferred method – cash, card, demand draft, etc.

Step 4: Don’t forget to collect the payment receipt from the counter after paying the amount.

Last Date of Bhopal Property Tax Payment

As per the rules defined by the state government, citizens of Bhopal must pay property tax twice a year. Once in June, the first half of the year and later in December, the second half of the year.

What Happens If You Don’t Pay Property Tax In Bhopal?

Not paying Bhopal property tax on time can invite a monthly penalty, such as 2% interest. The penalty exceeds when the house tax payment exceeds Rs 20,000, and the citizen still does not pay till December. In Bhopal’s case, it increases to 3% interest on the due amount per month. The penalty can get severe for repeated delays in payment of property tax in the city.

Apart from this, if you fail to pay property tax in Bhopal, then it may lead to serious consequences such as legal action or difficulty in any transaction. Yes, if you don’t make timely payment for property tax in Bhopal then it can even lead to property seizure and auction of the property.

This can even lead to difficulty in transactions too. Plus, not having up to date tax records can make it difficult to sell or even transfer your property. It may even affect your eligibility for financial products like a loan against property.

Thus, people must go through the payment process carefully and make timely payments.

Properties Liable for Payment of Bhopal Property Tax

All the properties, whether residential or non-residential, that are located within the urban local bodies are eligible for property tax in Bhopal.

To ensure correct tax assessment, citizens have to give the following details to the Town planning department, if applicable:

-

New Construction

-

Existing construction

-

Property upgrades

NOTE: Residential properties with an annual rental value of less than Rs.6000 in municipalities with a population of less than one lakh do not qualify for Bhopal property tax.

Components of Property Tax in Bhopal

As per the Madhya Pradesh Municipal Corporation Act, the council determines the tax applicable on lands and buildings in Bhopal within the Municipal limits. This includes components like:

-

Lighting tax

-

Water (or drainage tax)

-

Scavenging tax

-

General purpose tax

Bhopal Property Tax: List of Property Exemptions

As per Section 135, Bhopal Property tax is not viable on the following grounds:

-

Land, building or structure owned by:

-

State Government

-

Union Government

-

Corporation

-

Buildings or agricultural land beside a residing house

-

Building, plot or a portion of land used for educational purposes like a hostel, school, boarding school, library, etc and no rent is charged.

-

Buildings/Plots owned by an orphan, widow, minor or mentally/physically impaired individual are also eligible for tax exemption. The exemption limit in these cases is Rs 20,000 or the per year worth of the plot or building.

-

Abandoned or unoccupied land, plot, or building used for charity, worship, public burial, cremation, etc. Inherited structures or land used for these purposes are exempted from Bhopal Nagar Nigam tax payment.

-

Other exemptions include any building or plot on which business or related activities are carried. But the condition, in this case, is that the earned rent from these properties must only be used for religious purposes or public welfare.

-

Any state political party-owned property identified by India’s Election Commission also comes under tax exemption.

-

The following citizens can have one residential property for which they do not require paying Bhopal property tax:

-

Received the bravery award (highest order) from the government

-

A Receiver of Gallantry award in Defence Forces, Paramilitary Forces, or Police.

-

War veterans or armed forces personnel with a sustained disability between 76-100%.

Payment of property tax comes under the city’s Municipal Corporation. Thus, BMC is responsible for handling queries related to Bhopal Property Tax:

Address: Harshwardhan Complex

Mata Mandir, Bhopal, Madhya Pradesh, 462001

Email ID: commoffice@bmconline.gov.in

Mobile: +91-7552701222

Summing Up: Bhopal Property Tax

Payment of Bhopal property tax is a must for every responsible citizen. It is a source of income for the Bhopal Nagar Nigam/Municipal Corporation and helps improve your city’s facilities. While timely paying these taxes helps benefit from rebates, non-payment leads to penalties and even jail if the case is severe. Consult a BMC official if you face difficulty paying your tax, or reach out for online support via the MP e-Nagar Palika website.